31+ fha private mortgage insurance

Web Private mortgage insurance PMI is a type of insurance that conventional mortgage lenders require when homebuyers put down less than 20 percent of the homes. With a Low Down Payment Option You Could Buy Your Own Home.

What Is Mip Mortgage Insurance Premium

Discover Why So Many First Time Homebuyers Love PenFed FHA Loans.

. Web Because FHA-approved lenders take on more risk due to lower credit score and down payment requirements borrowers are responsible for paying FHA. Why Rent When You Could Own. Web Many home buyers are wondering if private mortgage insurance or PMI is still tax deductible in 2022.

Web Some lenders and servicers may also allow for earlier removal of PMI under their own standards. The most common is called private mortgage insurance or PMI and it is required on most conventional loans when the down. If you took out an FHA loan before that June 13 2012 and after Dec.

Private mortgage insurance is a type of insurance that some lenders require you to get with a mortgage loan. It includes an upfront charge equal to 175 percent of the loan amount as well as a monthly premium. The federal Homeowners Protection Act HPA provides rights to.

Get a Free Quote Now from USAs 1 Term Life Sales Agency. Web The conventional loan version of mortgage insurance is referred to as Private Mortgage Insurance PMI. Compare Plans to Fit Your Budget.

Web FHA MIP is the mortgage insurance program for FHA loans. Web There are many types of mortgage insurance. Credit Scores as Low as 620 with Only 35 Down Payment.

Discover Why So Many First Time Homebuyers Love PenFed FHA Loans. Web What is private mortgage insurance PMI. Credit Scores as Low as 620 with Only 35 Down Payment.

Web FHA MIP is the Federal Housing Administrations specific type of mortgage insurance. This policy gets its name because the policy is. With all of the media publishing articles about the tax reform it is.

The FHA charges two types of MIP. Web If you buy a home with a conventional loan private mortgage insuranceor PMIprotects your lender if you stop making payments on that loan. An upfront fee that equals 175 percent of your loan.

With a Low Down Payment Option You Could Buy Your Own Home. 31 2000 HUD allows you to drop mortgage. Web The exact amount your annual MIP will cost depends on your loan amount term and down payment.

Web Previous FHA Mortgage Insurance Rules. For example a borrower with a 30-year 300000 FHA loan on.

Understanding Private Mortgage Insurance Pmi

Fha Mortgage Insurance Who Needs It And How Much It Costs Forbes Advisor

Fha Requirements Mortgage Insurance For 2023

Fha Loan Mip Calculator Estimate Additional Loan Payment Costs Moneygeek

Fha Requirements Mortgage Insurance For 2023

Fha Requirements Mortgage Insurance For 2023

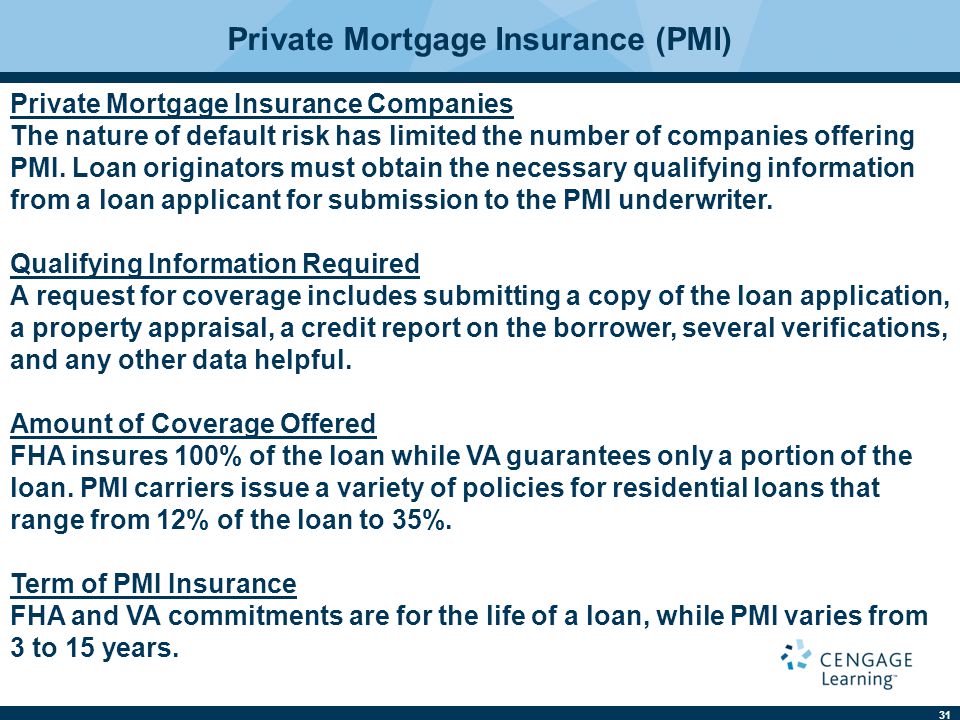

Real Estate Finance Ninth Edition Ppt Download

Fha Mortgage Insurance Guide Bankrate

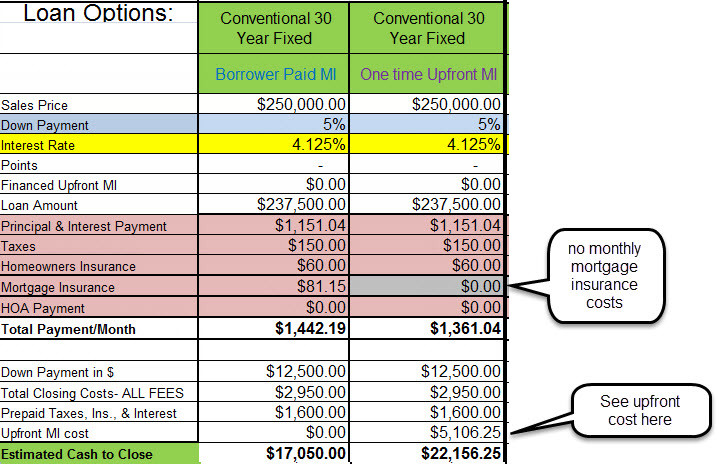

The Mortgage Brothers Show Signature Home Loans Phoenix Az

Fha Mortgage Insurance Help For First Time Home Buyers Bills Com

Fha Requirements Mortgage Insurance For 2023

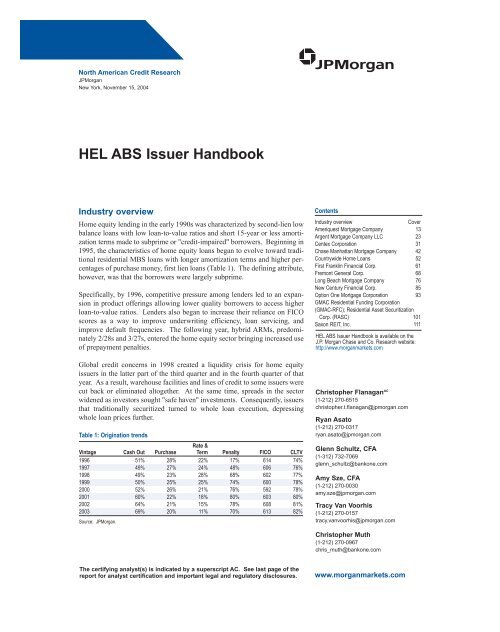

Handbook Final Qxd Securitization Net

Fha Loan Mip Calculator Estimate Additional Loan Payment Costs Moneygeek

A Guide To Private Mortgage Insurance Pmi

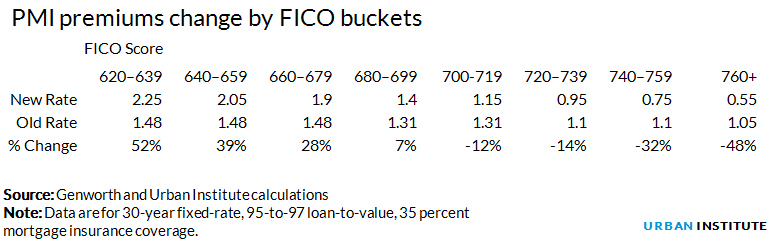

The Private Mortgage Insurance Price Reduction Will Pull High Quality Borrowers From Fha Urban Institute

Fha Loan Mip Calculator Estimate Additional Loan Payment Costs Moneygeek

Private Mortgage Insurance Friend Or Foe